Buoyed by Apple's iPhone launch and demand for IoT and GaN components, Qorvo's revenue grew modestly in the third quarter of fiscal 2018 to $846 million, up 3 percent sequentially and 2 percent year-over-year. Non-GAAP gross margin was 48 percent and operating margin was 30 percent, both higher than last quarter and last year's quarter. Diluted earnings per share was $1.69, $0.09 better than the midpoint of Qorvo's guidance.

Mobile Products

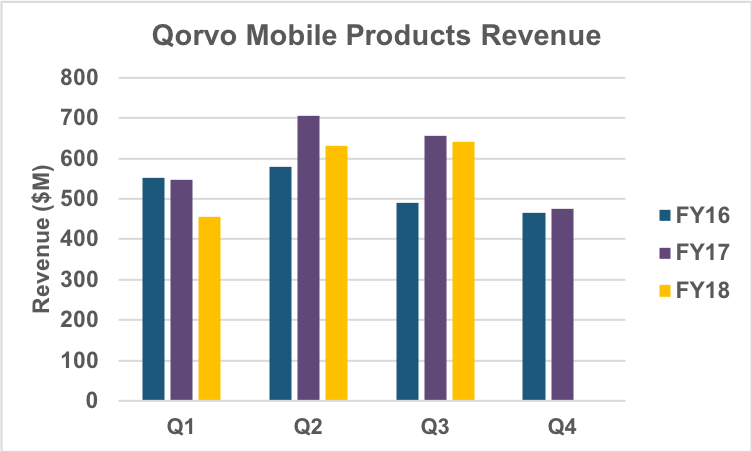

The mobile products segment contributed 76 percent of Qorvo's revenue, or $642 million, which was 2 percent above the prior quarter yet down 2 percent from the year-ago quarter. The mobile business benefitted from the launch of the iPhone X, iPhone 8 and iPhone 8 Plus and was hurt by soft demand in China.

During the earnings call, Qorvo CEO Bob Bruggeworth announced a design win at Apple for a front-end module (FEM) integrating the key filters and power amplifiers for the mid and high cellular bands, describing the win as "the most valuable and highly integrated placement in mobile RF, representing what we call the integration hub in the main path of the RF system." Later, Eric Creviston, president of the mobile business, said the FEM and other product wins will represent the "largest actual generation-over-generation content increase we have seen" at Apple. The FEM will ramp into production during the second half of 2018, timed to support the fall launch of the next iPhone.

Bruggerworth said Qorvo has sampled a second mid/high-band FEM to a different "tier 1 smartphone customer for their 2019 platform" — presumably Samsung.

Qorvo is shifting the product focus in mobile to the higher cellular bands, where BAW filters are favored over SAW, because of better performance, and the company's filter technology is more differentiated, with fewer competitors. Mobile will be more selective in pursuing SAW opportunities, according to CFO Mark Murphy, which will reduce the utilization of Qorvo's SAW fabs in Florida and North Carolina. The shift is a large element of Qorvo's effort to improve operating margins to 33 percent by fiscal year 2020.

Qorvo said mobile revenue in the March quarter will reflect the weakness in iPhone demand and continuing softness in China; revenue from the new design wins won't begin for a couple of quarters.

Infrastructure and Defense Products (IDP)

With strong demand from defense and IoT applications, IDP achieved record quarterly revenue of $203 million, growth of 20 percent year-over-year and 7 percent sequentially. IDP contributed 24 percent of Qorvo's revenue.

IDP's defense revenue grew 50 percent year-over year, capitalizing on the adoption of GaN in new systems and upgrades.

Revenue for "smart home" IoT applications grew 30 percent year-over-year, and IDP secured design wins in a Samsung remote control, HUMAX voice assistant and eldercare sensors in the Netherlands.

Demand for Wi-Fi infrastructure components was also strong. James Klein, IDP president, said the business "is doing very well" with products for 802.11ac, and "we think we are positioned very well" for the new 802.11ax standard, expected to ramp this year.

Qorvo's guidance is for IDP to achieve strong growth during the March quarter, with greater than 20 percent year-over-year growth and generating more than 30 percent of Qorvo's quarterly revenue.

Asked about Qorvo's use of cash, considering how the change in U.S. tax law addresses foreign profits, Murphy said "our first priority is to invest in the business." He expects capital investment in production capacity to decline, which allows more focus on M&A. "I am really excited about what James has done with the IDP business — lot of growth factors in that business — so certainly keen on bolt-ons."