Here’s my weekly compilation of interesting industry news:

Companies and Products

Broadcom, continuing its quest to acquire Qualcomm, proposed a slate of nominees for election to Qualcomm's board at the annual meeting in March. Hock Tan, Broadcom’s CEO, says, “Although we are taking this step, it remains our strong preference to engage in a constructive dialogue with Qualcomm.”

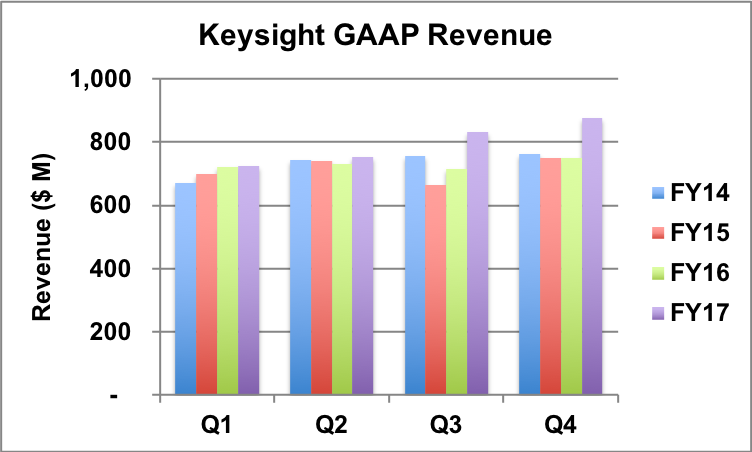

Keysight reported fiscal Q4 and full-year financial performance: GAAP revenue was $878 million, up 17 percent year-over-year, with record orders of $1.03 billion. The Communications Solutions segment grew 4.5 percent year-over-year, Electronic Industrial Solutions 2.5 percent and Services Solutions 1.9 percent. Keysight's full-year revenue was $3.2 billion, up 9 percent from fiscal 2016; interesting that approximately 80 percent of Keysight’s year-over-year growth was contributed by Ixia, which Keysight acquired on April 18.

The wildfires in California’s wine country in October closed Keysight’s headquarters site in Santa Rosa for three weeks and destroyed the homes of 119 employees. Keysight described the company’s response to the crisis in this Harvard Business Review article. The company's support of employees who lost homes or were displaced is inspiring and honors the philosophy established by HP founders Bill Hewlett and David Packard.

Marki Microwave expanded the portfolio of small, low-cost MMIC slope equalizers, adding DC–7, DC–14 and DC–20 GHz families. The equalizers offer DC attenuation options ranging from 3 dB to 10 to 12 dB.

Northrop Grumman's acquisition of Orbital ATK will take longer, following the Federal Trade Commission’s (FTC) “second request” for more information to assess potential anti-trust conflicts. In a release, Northrop Grumman said the company still expects to close the deal during the first half of 2018. The $7.8 billion acquisition was announced in September.

Qualcomm unveiled the features in its new Snapdragon 845 processor for mobile phones, including the X20 LTE modem — capable of data rates to 1.2 Gbps — and support for 802.11AD Wi-Fi and Bluetooth 5.0. Chinese cell phone manufacturer Xiaomi plans to be the first to use the processor, in the Mi 7 phone.

Wolfspeed released an internally-matched, GaN on SiC power amplifier for EW and radar. The CG2H30070 covers 500 MHz to 3 GHz and delivers 70 W CW with 55 percent drain efficiency and 12 dB power gain. Combining two devices yields greater than 100 W CW from 700 MHz to 3 GHz at +85ºC.

Markets and Technology

Cellular/5G — Ericsson produced an informative webinar explaining the highlights from the latest Ericsson Mobility Report, including insights into current network traffic and forecasts through 2023. The webinar can be viewed here.

In a lab demo, T-Mobile and Ericsson claimed a new speed record of 1.1 Gbps download data rate with 12-layer licensed assisted access (LAA). LAA combines LTE with the unlicensed, 5 GHz Wi-Fi spectrum to aggregate sufficient bandwidth to carry gigabit data rates.

Yet another “5G” demonstration: Huawei and NTT DOCOMO demonstrated 4.52 Gbps downstream and 1.55 Gbps upstream at 28 GHz over a 1.2 km line-of-sight link in Tokyo.

Industry trade association 5G Americas published a white paper discussing the cellular standards for low power wide-area networks (LPWAN) for IoT applications. Download and read here.

T-Mobile requested FCC approval to evaluate the E-Band spectrum (71 to 76 and 81 to 86 GHz) for 5G backhaul in urban locations. The application identified Ceragon’s 1024-QAM radios, which will be tested in Bellevue, Washington. By 2020, T-Mobile plans to deploy 5G using the nationwide, 600 MHz spectrum the company won in an FCC auction last April.

European Union (EU) telecommunications ministers agreed on a 5G roadmap for development and rollout across the EU. The roadmap set the stage for a meeting with European Commission and European Parliament representatives on 6 December to discuss the controversial Electronic Communications Code (ECC). Critics of the ECC say the regulations are restrictive and will hinder 5G adoption in Europe.

Of the three use cases envisioned for 5G — enhanced mobile broadband, massive machine-type communications and ultra-reliable low latency communications (URLLC) — URLLC has received the least attention, yet may prove the most impactful. In a recent blog post, James Kimery of National Instruments discusses designing a network for low latency.

Autonomous Vehicles — Waymo’s fleet of autonomous vehicles has accumulated 4 million self-driven miles, achieving the last million in just six months. During the past year, Waymo also simulated 2.5 billion driving miles.

Aerospace — Via Satellite profiles the satellite development and launches by smaller countries, ones we don't usually think of. There's a lot going on up there.

China — The Chinese government announced infrastructure projects for 5G networks, optical fiber broadband and quantum communications. 5G will initially be deployed in five cities, with at least 50 base stations in each. Network performance goals are 100 Mbps with millisecond latency for each user.

Last Words — If you’re involved in antenna design or want to learn about it, a free webinar shows how CAD software AntSyn can design a compact, dual-band Wi-Fi, MIMO array. Watch it here.

General Dwight Eisenhower said, “Plans are worthless, but planning is everything.” How well does your company plan? Too often, companies are consumed with day-to-day operations and neglect their futures. Consultant Doug Dawson offers some best practices he’s observed, from companies that plan well.

We offer congratulations to Altair’s C.J. Reddy, who was elected a 2018 IEEE Fellow for his “leadership in simulation methods for antenna placement and co-site analysis.”

Thoughts? Please leave a comment below.