The ‘killer app’ for 5G and 6G systems has been a major question for the mobile industry, so when we talk with various players, we get a range of viewpoints. Will AR/VR drive 5G and 6G markets like email drove 3G? Or like Google Maps/Uber/Facebook drove 4G?

So far, it appears that 5G is different. The operators are not deploying 5G for higher speeds to support apps at gigabit speeds. Instead, operators are deploying 5G to boost capacity in the network, where the higher speeds/wider bandwidths of 5G channels are useful.

The business challenge for the operators is that revenue has stopped growing quickly, but data demand is continuing to grow at 30 to 50 percent per year. This means that the operators need to add capacity while dropping their cost/GB at least 30 percent per year.

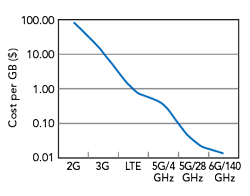

A brief study of history shows us that such rapid cost reduction is possible, if we can use wider blocks of spectrum and techniques like massive MIMO to drive much higher throughput in each radio (see Figure 1). Through this lens, it seems obvious that sub-THz is the next step for mobile technology.

Figure 1 Cost per GB of data by cellular generation, historic and projected.

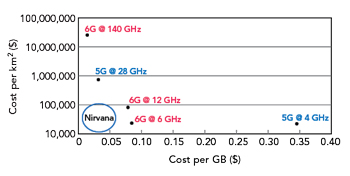

Figure 2 Trade-off between frequency spectrum data capacity and coverage.

But there’s a problem; signals over 100 GHz won’t penetrate a wet paper bag or the windshield of a car. The propagation of this signal means that huge capacity will be available, but only in a tight space (see Figure 2).

We can imagine applications where short propagation and huge bandwidth can be useful. Try to watch a video at an NFL stadium on game day. Try to equip an automotive manufacturing plant with thousands of 8K resolution cameras for automation and inspection, using a wireless network. Yes, it is believed that we will add a layer of capacity in sub-THz bands for these applications, but we must recognize that they will be niche opportunities. Sub-THz will only work in places where poor propagation and penetration are acceptable, or helpful because they enable us to re-use spectrum.

In addition to sub-THz spectrum, mobile operators will push for better use of any band they can get below 15 GHz. They need RF channels that can penetrate through brick, wood and glass so that indoor customers can use the capacity that they provide—remember that 80 percent of mobile traffic happens indoors, so doubling the outdoor capacity with poor penetration is useless.

Leading up to the 6G cycle, we can identify a few bands that will be interesting:

The U.S. has allocated the 6 to 7 GHz spectrum for unlicensed operation, with some strict power limitations. But China appears likely to use this band for licensed 5.5G or 6G services…roughly 300 to 400 MHz could be allocated to each of the three major operators there. DISH, RS Access and a few other companies hold spectrum licenses at 12 GHz. The 12 GHz MVDDS band can be re-purposed from television to wireless broadband, with a fat block of 500 MHz.

Figure 3 Cost per GB of data vs. cost per km2 of coverage.

Many other bands below 6 GHz are under-utilized. Radionavigation, broadcast, radar and other systems have been deployed for 80 years with spectrum set aside 100 percent of the time. Is this necessary in our connected world? Imagine a radionavigation system that only transmits on a 10 percent duty cycle. Ships are not likely to go off course if they get updates on their backup system every 900 milliseconds. Looking over the FCC chart of spectrum usage, it seems that more than 2 GHz of bandwidth could be liberated, by shifting to a spectrum-sharing strategy similar to CBRS.

So, we need to pursue two goals with 6G: we must reduce cost per GB so that the mobile operators can make a profit, but we must also achieve reasonable coverage so that the capacity is available where it’s needed.

During the 2G/3G cycles, we said that the 800 to 900 MHz band was “beachfront property” because the propagation is excellent. LTE networks at 2 GHz were ideal because of their combination of coverage and capacity. For 5G, we call the 2.5 to 3.5 GHz bands the “Goldilocks zone.” Do you see the trend? As data demand grows, our concept of the ‘best’ spectrum is moving higher.

The most compelling band for 6G may be the 6 to 7 GHz band (see Figure 3), where cost per GB and cost per square kilometer of coverage are both optimized, with fairly good penetration of walls. The U.S. has already given away this band, but operators in China and a few other countries will achieve an excellent cost profile this way. American operators and others will need access to wide blocks at 12 GHz or below to succeed.