This is a good sign for 2010 as ABI estimates 336.5 million handsets were shipped in Q4-2009, up 15.1% QoQ. “2009 may have started with a whimper but by 4Q-2009 the global mobile handset market ended with a pretty reasonable bang,” says Jake Saunders, Vice-President for Forecasting at ABI Research. But competition continued to squeeze handset ASPs as Q4-2009 shipment-based ASPs were down 2% to $117.55.

The US stimulus package certainly helped save the mobile handset industry according to Saunders. “Renewed consumer confidence in the second half of 2009 meant that shipments for the whole year only shrank 4.5% to 1.153 billion. Dire scenarios were mooted in early 2009. There is cautious optimism about 2010 despite the fragile nature of the global recovery. ABI Research forecasts shipments to expand to 1.2 billion handsets in 2010.”

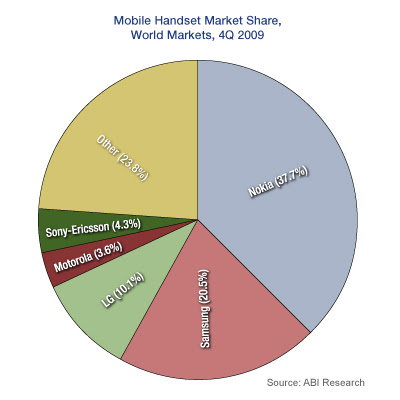

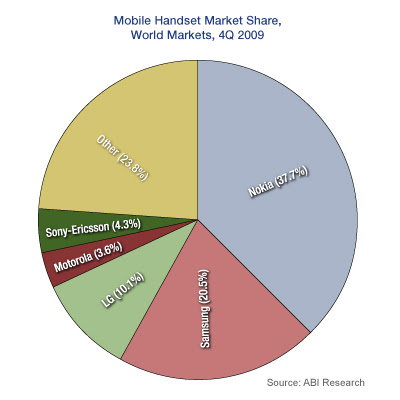

Despite Nokia’s weakened position in the smartphone segment, it still managed to maintain 37.7% of the overall handset market. Samsung seems unstoppable - between June 2008 and December 2009, they increased its market share from 15.2% to 20.5%. Samsung has benefited from a strong line-up of feature phones as well as a strong reputation for innovative smartphones. Korea’s level of influence over the handset market is further underscored by LG, the third-largest handset vendor (10.1%). LG has been counting on its S-Class smartphone series to help it secure a bridgehead in the market.

“In 3Q-2009, Motorola, under the direction of Sanjay Jha, has come out of its corner fighting with a refreshed portfolio,” adds practice director Kevin Burden. “The Droid has received critical acclaim. However Motorola’s market-share continued to contract to 3.6%.” Sony-Ericsson also experienced a contraction to 4.3% but has high hopes that its Android-based handsets will generate renewed interest. It only seems like a few years ago that Motorola was approaching Nokia for the market leading position but they have really suffered over the years.

HTC’s market share did not fare well early last year. but its circumstances improved slightly in 4Q, to 1.0% share. Notably, HTC announced a revamped handset portfolio strategy, not just targeting high-end smartphones but also launching smartphones that appeal to purchasers with smaller wallets. These low cost “HTC Smart” devices will rely on BREW.

The US stimulus package certainly helped save the mobile handset industry according to Saunders. “Renewed consumer confidence in the second half of 2009 meant that shipments for the whole year only shrank 4.5% to 1.153 billion. Dire scenarios were mooted in early 2009. There is cautious optimism about 2010 despite the fragile nature of the global recovery. ABI Research forecasts shipments to expand to 1.2 billion handsets in 2010.”

Despite Nokia’s weakened position in the smartphone segment, it still managed to maintain 37.7% of the overall handset market. Samsung seems unstoppable - between June 2008 and December 2009, they increased its market share from 15.2% to 20.5%. Samsung has benefited from a strong line-up of feature phones as well as a strong reputation for innovative smartphones. Korea’s level of influence over the handset market is further underscored by LG, the third-largest handset vendor (10.1%). LG has been counting on its S-Class smartphone series to help it secure a bridgehead in the market.

“In 3Q-2009, Motorola, under the direction of Sanjay Jha, has come out of its corner fighting with a refreshed portfolio,” adds practice director Kevin Burden. “The Droid has received critical acclaim. However Motorola’s market-share continued to contract to 3.6%.” Sony-Ericsson also experienced a contraction to 4.3% but has high hopes that its Android-based handsets will generate renewed interest. It only seems like a few years ago that Motorola was approaching Nokia for the market leading position but they have really suffered over the years.

HTC’s market share did not fare well early last year. but its circumstances improved slightly in 4Q, to 1.0% share. Notably, HTC announced a revamped handset portfolio strategy, not just targeting high-end smartphones but also launching smartphones that appeal to purchasers with smaller wallets. These low cost “HTC Smart” devices will rely on BREW.