Here’s a summary of interesting industry news from this past week:

Companies and Products

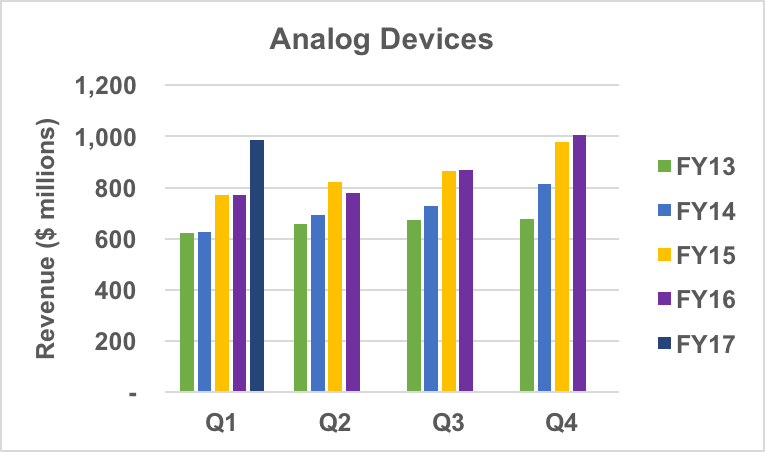

Analog Devices (ADI) reported a “stellar” start to their new fiscal year (FY17). Q1 revenue was $984 million, up 28 percent year-over-year. The communications segment grew 3.6 percent year-over year and 1.3 percent sequentially to $174 million.

ADI acquired Hittite on 22 July 2014, two-and-a-half years ago. During ADI’s earnings call, an analyst asked about “revenue synergies” that came from the acquisition. CFO Dave Zinsner and CEO Vince Roche answered, with Zinsner estimating the combined company has captured $100 million in revenue that neither company could have captured alone:

Anritsu launched a family of Spectrum Master™ ultraportable millimeter wave spectrum analyzers. The models in the MS2760A family offer various high ends: 32, 44, 50, 70, 90 and 110 GHz. The MS2760A is less expensive than benchtop alternatives, and its portable size makes it convenient for field testing and production testing large products.

Cree terminated the Wolfspeed sale to Infineon after the companies were unable to address the national security concerns raised by the Committee on Foreign Investment in the United States (CFIUS). Wolfspeed will stay with Cree. Chuck Swoboda, CEO of Cree, said, “The strength of our balance sheet and improving operating cash flow gives us the ability to invest in Wolfspeed, while continuing to pursue our LED and lighting growth plans. We believe investing to grow all three businesses will create the most value for our shareholders.”

You may recall the recent announcement by GLOBALFOUNDRIES to expand their global fab capacity. One element of that expansion is a new 300 mm, 22 nm FD-SOI fab in Chengdu, supported by investment from the Chengdu municipality. Will this fly under the radar of the Trump administration?

Acquisition of the week: IDT will acquire GigPeak for $3.08 per share, IDT will spend a total of approximately $250 million to gain GigPeak's optical and ASIC segments. GigPeak will operate as a standalone unit of IDT's computing and communications division.

Jumping into the optical market, IDT will be competing with Inphi, MACOM and Qorvo. However, IDT’s CEO deosn’t seem to be concerned, judging from comments he made during a call discussing the deal with financial analysts:

Keysight Technologies reported fiscal Q1 revenue of $726 million, which was flat with the prior year’s quarter. Aerospace and defense orders dropped 20 percent year-over-year, with softness from the U.S., Russia and China. Orders from the remaining segments increased 11 percent year-over-year.

5G has been one of the bright spots for Keysight. Communications group senior VP Mike Gasparian discussed the 5G outlook during the earnings call:

MaxLinear released a dual-channel 32 Gigabaud linear coherent transimpedance amplifier (TIA) for 100G/200G dense wavelength division multiplexing (DWDM) coherent systems. The MxL9105's pin-out and functionality are compatible with legacy 32 GBd coherent TIAs currently on the market.

We haven’t heard much about Peregrine Semiconductor’s mobile strategy or products since they were acquired by Murata. However, they just announced a new RFIC design center in Austin, with the mission to develop UltraCMOS® PAs, LNAs and switches for mobile. The design center will be led by 25-year industry veteran David Bockelman. He was VP of engineering at startup Javelin Semiconductor, formed to develop CMOS PAs for mobile phones. Javelin was acquired by Avago/Broadcom in 2013.

Skyworks introduced a family of front-end modules (FEM) targeting China's LTE market. The SkyOne Ultra 2.5 modules — comprising three multi-band FEMs, a 2G PA module and a power management IC for the RF front-end — support both global and regional phone architectures.

TowerJazz ended 2016 setting records. 2016 revenue grew 30 percent from 2015 to $1.25 billion. Q1 revenue guidance is for 19 percent year-over-year growth.

Markets and Technology

Semiconductors — The University of Bristol was awarded a £4.3 million grant from the Engineering and Physical Sciences Research Council (EPSRC) to work with four other U.K. universities to develop GaN on diamond technology. The program will target more than a 5x increase in power compared to commercially available GaN on SiC HEMTs.

5G — As we move toward 5G, the separation between cellular and Wi-Fi will disappear. Five trends are leading to this convergence, according to Adlane Fellah, founder of WiFi360.

To enable the transition to 5G, Nokia announced plans to deploy “4.9G” technology by the end of 2017. Their 4.9G offering includes a massive MIMO adaptive antenna that will increase cell capacity by up to 5x and a 4.5G Pro AirScale Micro Remote Radio Head (RRH), which will enable operators to use unlicensed spectrum to achieve Gbps data rates.

Broadband — Ajit Pai, the new chairman of the FCC, opposed the net neutrality rules when they were implemented under Tom Wheeler in 2015. However, he hasn’t disclosed what he intends to do about them, now that he has the reins to the commission.

IoT — AT&T plans to deploy an LTE-M IoT network across the U.S. during calendar Q2 of this year and one in Mexico by year-end. They are currently running multiple pilots in California and Ohio.

AT&T plans to pilot a “smart cities” program in Chicago. Initially, the company will install five touchscreen kiosks that provide links to informance and services — but not internet access.

Thoughts? Leave a comment below.