Here’s a summary of news from the past week that I found worth passing along:

Companies and Products

Ampleon is opening an RF energy competence center in Hefei, China, intended to accelerate adoption of solid-state cooking. Ampleon will provide white goods manufacturers based in China with local integration and application support.

The Analog Devices acquisition of Linear Technology cleared three hurdles: U.S. antitrust approval, German government clearance and the okay from Linear's stockholders.

Anokiwave joined the 3GPP as a guest member, which will allow the company to observe and informally influence the 3GPP’s 5G standards — millimeter wave being their main interest.

Broadcom released a 4x4 802.11ac Wave 2 radio that extends Wi-Fi coverage and improves video streaming.

DragonWave was selected to supply microwave backhaul radios to U.S. cellular operator Sprint, as Sprint moves to densify its cellular network.

Ericsson reported a $26 million loss from fiscal Q3 operations, resulting from a 14 percent year-over-year revenue decline and lower gross margin of 28 percent. Infrastructure demand is weakending and competition intensifying (i.e., Huawei and Nokia).

Fujitsu is developing a 76 to 81 GHz CMOS signal generator and four channel transmitter for automotive radar, targeting commercial release in 2020.

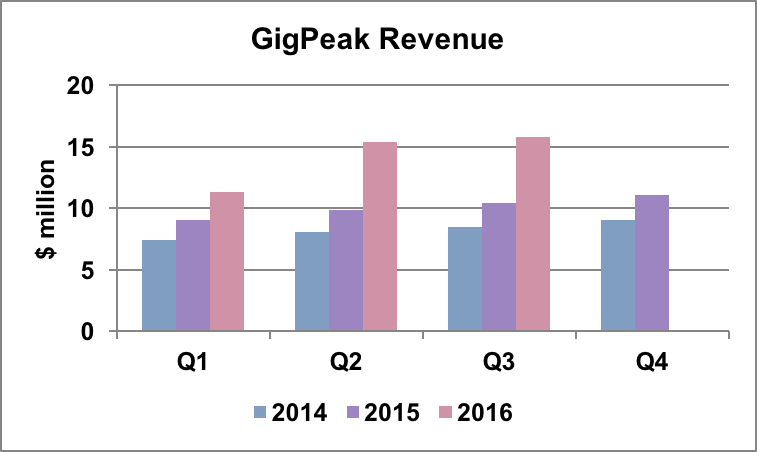

GigPeak reported fiscal Q3 revenue of $15.8 million, a sequential increase of 3 percent and 52 percent growth above the prior year’s quarter. Data center demand, dominated by 40G QSFP+, drove the sequential growth.

Lockheed Martin completed building more than 15,000 LRUs for the Space Fence S-Band radar, containing 36,000 GaN HPAs. Read a profile of the radar in Microwave Journl’s August supplement.

Qualcomm announced their Snapdragon X50 modem, the first modem developed for 5G. It supports 5 Gbps download and multi-element arrays operating at 28 GHz.

Raytheon was awarded a $14.9 million AFRL/OSD contract to improve GaN performance, yield and reliability. The Next Generation Jammer (NGJ) is slated to receive the first insertion of technology developed on the program.

London’s City Airport has successfully introduced and tested Rohde & Schwarz’s E-Band security scanner. Passengers stand in front of the scanner with their arms held slightly away from the body. If the scanner reports an alarm, the location of the object is marked on a graphic of the human body, with a neutral display preserving the privacy of the passenger.

Skyworks is targeting TDD-LTE high power user equipment (HPUE) with their SkyOne® Ultra 2.0 and SkyLiTE™ 2.0 families of mobile front-ends.

Wolfspeed’s fiscal Q1 revenue was $50 million, according to parent Cree. The acquisition by Infineon is expected to close by year end, despite a “second request” from the Federal Trade Commission (FTC). The FTC wants additional info to judge whether the acquisition poses an antitrust threat. Read a summary of the earnings release.

Markets and Technology

Cellular — Stage 2 of the FCC's 600 MHz auction stalled after a single round of bidding. The bids reached $21.5 billion for 90 MHz of spectrum, enough to proceed to Stage 3.

TSMC's Q3 results suggest demand for the iPhone 7 has been strong, according to Mark Hibben.

To reduce the size of infrastructure equipment, the cellular industry is moving from 7/16 to 4.3-10 connectors. In this video interview, Heino Cumpanas of Huawei discusses the NGMN's efforts to develop an industry-wide roadmap for the transition.

GaAs — Eric Higham, analyst at Strategy Analytics, says as smartphone adoption saturates, the GaAs market is “running out of gas”. Yet he sees hope in 5G.

The Economy — Despite campaign promises to jump start U.S. economic growth, such rhetoric isn't realistic according to Marc Levinson, former finance and economics editor of The Economist, writing in The Wall Street Journal.

Across the globe, with easy credit and a hot housing market, China reported 6.7 percent growth in Q3, which met the government's goal of 6.5 percent.

Your feedback about content is always welcome. If you have a topic that you’d like to see in the weekly report, please send it to me at glerude@mwjournal.com.

Have a good week.