Here's a summary of the industry news that caught my attention last week. Lots of earnings releases, which are always informative.

Companies and Products

Cobham Microelectronic Solutions received a $51 million order from BAE Systems for radar and EW components for the F-35.

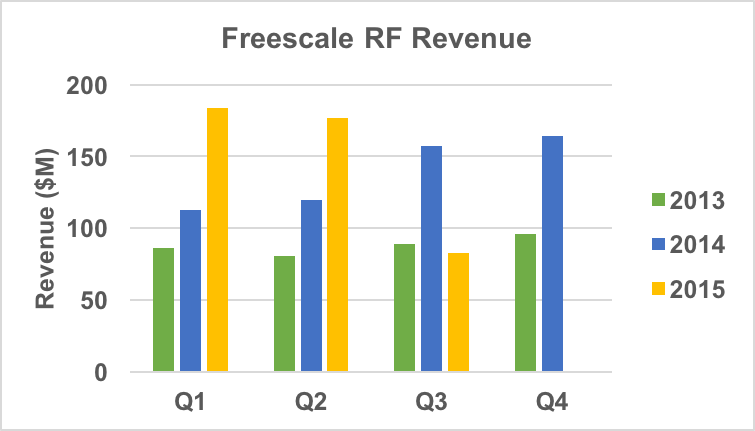

Freescale reported Q3 RF revenue of $83 million, down 53 percent from Q2 and 47 percent below last year's quarter. The ugly quarter stemmed from wireless infrastructure softness in China.

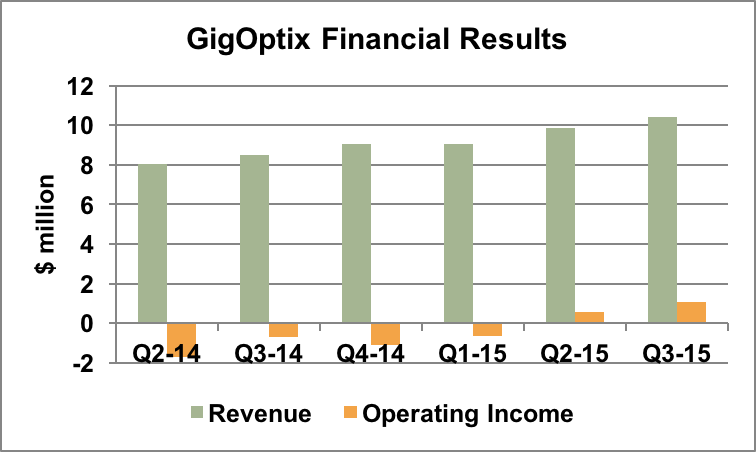

GigOptix reported a record quarter, posting Q3 revenue of $10.4 million, up 5.9 percent from last quarter and 23 percent greater than the prior year's quarter. The company said the success came from strong demand for 40G drivers and TIAs.

Huawei demonstrated 1.34 Gbps average downlink data rate in a 5G field trial with NTT DOCOMO.

In the latest twist in the consolidation of the semiconductor industry, Microsemi offered $2.4 billion for PMC-Sierra, topping Skyworks' $2 billion bid. Will Skyworks counter? The Wall Street Journal surveyed the wave of semiconductor consolidation. "It's buy or be sold," says Alex Lidow, CEO of Efficient Power Conversion and a GaN advocate.

China's MOFCOM approved the Nokia acquisition of Alcatel-Lucent. After obtaining the go-ahead from France's Ministry of Economy, the companies will ask for shareholder approval.

Qorvo announced a linear PA for automotive vehicle-to-vehicle and vehicle-to-infrastructure (V2x). The QPA5525Q is undergoing AECQ-100 Grade 2 testing; production is scheduled to follow later this quarter.

Raytheon reported Q3 revenue of $5.8 billion, 5.6 percent above the prior year's quarter. EPS was $1.47, down from $1.65 a year ago. Read segment details in the earnings release.

Remcom released an update to their Wireless Insite EM propagation software. It's now able to import KMZ and COLLADA geometry files and better simulate larger and more complex urban scenes.

Skyworks won multiple designs in the OnHub router built by TP-LINK, racking up 20 sockets in the router's multiple radios. Investors Business Daily wrote a profile of Dave Aldrich, Skyworks CEO. It's an insightful story of key lessons learned and how Aldrich has created a winning culture.

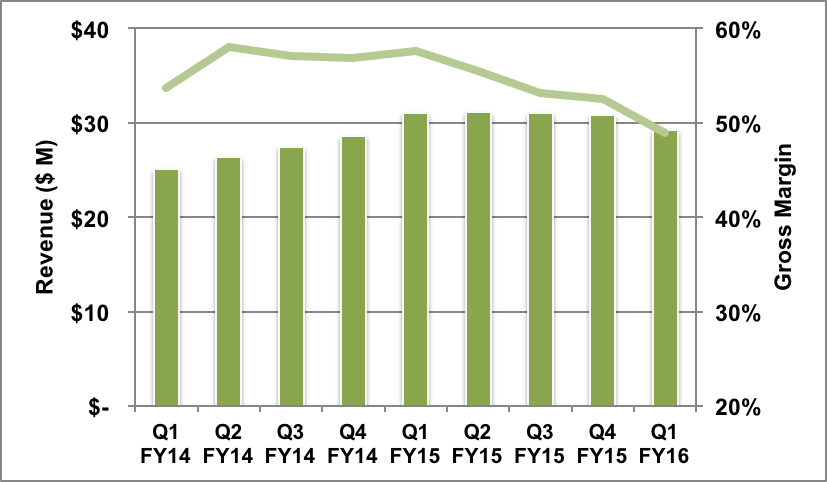

Wolfspeed (Cree's power and RF segment) reported quarterly revenue of $29 million, down 5 percent from the prior quarter. The decline reflects delays in the LTE rollout in China. Wolfspeed achieved 49 percent gross margin in the quarter, which was down 3.5 points from the prior quarter.

During Cree's earnings call, CEO Chuck Swoboda discussed the outlook for Wolfspeed and plans to sell equity in the power and RF segment.

During the same call, a financial analyst asked Swoboda if Wolfspeed has the scale to be successful, considering all the semiconductor consolidation taking place. His answer:

Swoboda also shared his perspective with the Triangle Business Journal.

Markets and Technology

5G — The FCC will issue a rulemaking that designates the 28, 37, 39 and 64-71 GHz bands for 5G services in the U.S. At WRC-15 (World Radiocommunications Conference), the FCC will propose that these same bands be used globally.

Volker Held of Nokia Networks has written the clearest synopsis of 5G that I've read.

IoT — GE, already a major player in industrial IoT, views security as important as the sensors on equipment.

China — Q3 GDP was reported to be 6.9 percent, the lowest since the great recession, amplifying concerns about the country's economy.

Have any comments or tips about interesting news? Send them along and have a good week.