Figure 1 Military radar. Source: Alarmy.com.

The military radar segment covered in this article includes radar technology used for applications like monitoring aircraft and missiles, managing air-to-air missiles and guns along with detecting potential threats such as hypersonic missiles and drones. Military radar technology has advanced significantly over time. These systems have become crucial components of broader detection and tracking networks for military operations due to improvements in radar resolution, range and detection capabilities.

There are several different kinds of military radars, including air defense radars, early warning radars and ground surveillance radars. These systems have become an indispensable part of top-level defense strategies. The strategic objective and eventual success of these military applications are supported by the rapid evolution of radar systems, typically driven by technological and digitization breakthroughs. A typical military radar antenna is shown in Figure 1.

Decoding the Future of Military Radar

Radar is an umbrella term used to refer to a wide spectrum of techniques and devices for detecting and surveying objects using radio waves. Radar systems cover a wide range of applications, including ground-penetrating radar, weather radar and air traffic control radar, in addition to more defense-related applications like search, fire control and surveillance radar. The ability to identify objects using radio waves makes radar a general name for a variety of remote sensing technologies.

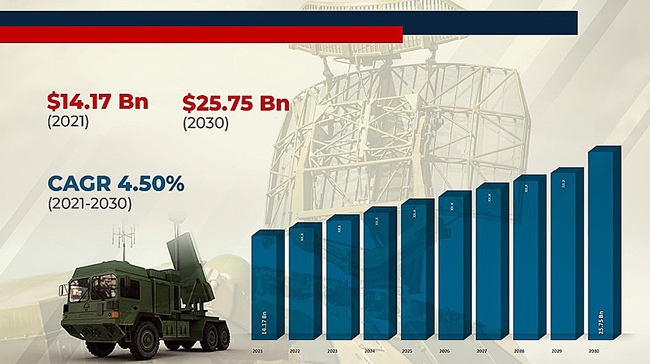

Extrapolate says that the military radar market size is likely to reach $25.75 billion by 2030, recording a healthy CAGR of 4.5 percent during the 2021 to 2030 forecast period.1 These numbers are clear indications that the market is poised for robust growth in the near future. As a result of the breakthroughs and trends sweeping the industry, military radar is anticipated to advance quickly, transforming defense forces along the way. The forecast graphic associated with the Extrapolate report is shown in Figure 2.

Figure 2 Military radar market forecast. Source: Extrapolate.

Radar is used in defense applications to locate missiles, ships, airplanes and spacecraft that represent a threat from the air, land, water or space. Radar devices are also crucial to the task of locating explosives and landmines that are concealed from view. One of the most popular products in the military radar sector that has significant demand on a global scale is lightweight radar. High demand for these radars will create a large market opportunity for these systems. The global military radar sector is being driven by increased national spending to strengthen home defense and border defense forces.

What Is Driving the Military Radar Market?

Military radar is gaining immense popularity as border disputes increase. These disputes point out the need for improved defense capabilities. The Middle East has a long history of conflict due to disagreements over borders and hostilities in areas like Saudi Arabia, Iraq and Syria. In light of regional power uncertainties and local conflicts, the region has experienced an increase in the appetite for weapons and defensive systems. Regional markets are growing in response to increasing border disputes and political upheaval in neighboring countries and this uncertainty influences the procurement of cutting-edge weapons.

These factors are fueling increased defense expenditures and the acquisition of military radars to address potential threats. According to “The Economic Times,” the world’s military spending has surpassed $2 trillion for the first time.2 The U.S., the world’s largest economy, remains the biggest spender, according to a report released by the Stockholm International Peace Research Institute (SIPRI), a Swedish defense think tank. In its 2021 report,3 SIPRI stated that overall global military expenditure increased by 0.7 percent in real terms to $2,113 billion in 2021. The U.S., China, India, the U.K. and Russia were the top five spenders in 2021, collectively accounting for 62 percent of expenditures. Military budgets are also anticipated to benefit from the shift from traditional combat to electronic and cyber warfare.

Another defense budget driver is the pressing demand to track global terrorist activities. These and other activities are increasing geopolitical tensions, which also contribute to increasing defense expenditures in developing countries, especially in the Middle East and Asia-Pacific regions. These demands have pushed various countries to develop radar systems that are suited to specific needs and criteria. In April 2021, as an example, China launched a portable and adaptable radar that can detect stealth aircraft, cruise missiles and drones.

Increasing investment in military radar is driven by the need to improve air defense capabilities by incorporating new technological developments and an increase in combat aircraft acquisition. Market growth is constrained by the size of early-stage investments, the inability to detect small targets, like drones and strict cross-border trading regulations. The escalation of geopolitical tensions and the expansion of military radar research and development for airborne platforms are anticipated to create profitable business opportunities for manufacturers of military radar equipment in the market.

Military Radar Trends

As military radars evolve, regional defense agencies are increasingly integrating technology and innovative features as differentiators against other countries. An emerging radar trend is the introduction of MIMO phased array radars. An array of antennas with digital receivers that can transmit any waveform is a mainstay of the architecture of these MIMO radars.

MIMO radars are the evolution of active electronically scanned array (AESA) radars. AESA radars are still widely used, providing substantial advantages over mechanically or passively scanned radars, but they are potentially heavier and more expensive than the next-generation MIMO radars. These radars can use a 3D range because of the number of elements and transceivers. The new MIMO technology is anticipated to outperform the current AESA systems for ground radar applications. MIMO radars also offer greater jamming resilience capacity when compared to AESA radars and this also contributes to its growing demand.