To keep up with the exponential growth of mobile traffic globally, mobile network operators (MNOs) are massively deploying 5G networks. At the same time, they are shutting down their 3G and 2G services to free up the cell site spectrum for 4G and 5G. Globally, 5G is being deployed at two different paces, with China supporting half of the base transceiver station (BTS) market while the rest of Asia, Europe, the U.S. and late 5G entrant India dominate the balance of the market. Figure 1 shows our latest base station forecast by region.

Figure 1 Macro/Micro regional BTS forecast. Source: RF for Radio Access Network (RAN) 2023 report, Yole Intelligence, 2023.

We estimate that 5G comprises more than 70 percent of the investment from the MNOs. MNOs are expected to continue investing massively in 5G in the upcoming years and this will continue to expand the 5G footprint. The first wave of investment mainly focused on 5G Non-Standalone (NSA), involving only new radios, to ensure a fast time to market and a smooth cohabitation with 4G. The second wave is now focusing on the baseband and core networks, where evolution is critical to provide 5G Standalone (SA) that enables new use cases and levers for monetization. There are big expectations for RAN and RF front-end (RFFE) market opportunities in 2023, primarily due to an ambitious launch of 5G networks in India. The question becomes; will it last over the next few years?

MARKET DRIVERS COME OUT OF MNO REQUIREMENTS

5G is bringing massive network capacity improvements by using new spectrum in the sub-6 GHz frequency band while reusing legacy 4G bands. 5G architectures leverage traditional remote radio heads (RRHs) and active antenna systems (AAS). The use of massive MIMO (mMIMO) is a crucial technology to improve AAS spectral efficiency and throughput. Mainstream mMIMO systems use 32 or 64 streams and this has a huge impact on the number of RF lines compared to legacy RRHs that typically had 2 to 8 TRx. Although the mMIMO architecture is much more efficient than an RRH architecture in terms of gigabits per kilowatt, AAS consumes much more power than legacy RRH. With the increase in mMIMO penetration, the trend toward higher-power radio units (RUs) with transmit power above 300 W is becoming the norm.

This rising concern about energy consumption is a serious challenge for MNOs. This is becoming increasingly problematic as energy prices are rising and sustainability is becoming important for consumers, politicians and investors. Various sources estimate that BTS energy consumption is between 20 and 40 percent of an operator’s OPEX, representing one of the highest contributors to that expense. Addressing this energy issue is critical because MNOs cannot deal with increasing OPEX on one hand and increasing CAPEX to support expensive 5G hardware deployment on the other.

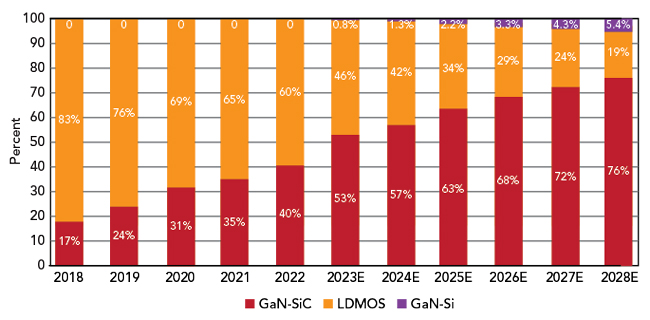

To address the energy issue, original equipment manufacturers (OEMs) are focusing on power amplifiers (PAs). These devices consume the most power in the radio and drive high transmit power levels but they suffer from limited efficiency. Huawei was the first to trade the low-cost laterally-diffused metal-oxide semiconductor (LDMOS) power transistor technology for the better power-added efficiency of GaN technology solutions. With the increasing need to optimize power consumption, the transition toward GaN-based RUs is accelerating. The supply chain has adapted accordingly to support the growing demand for GaN devices. Our market share forecast for the various PA technologies is shown in Figure 2.

Figure 2 Forecast of final PA technology in BTS RAN. Source: RF for Radio Access Network (RAN) 2023 report, Yole Intelligence, 2023.

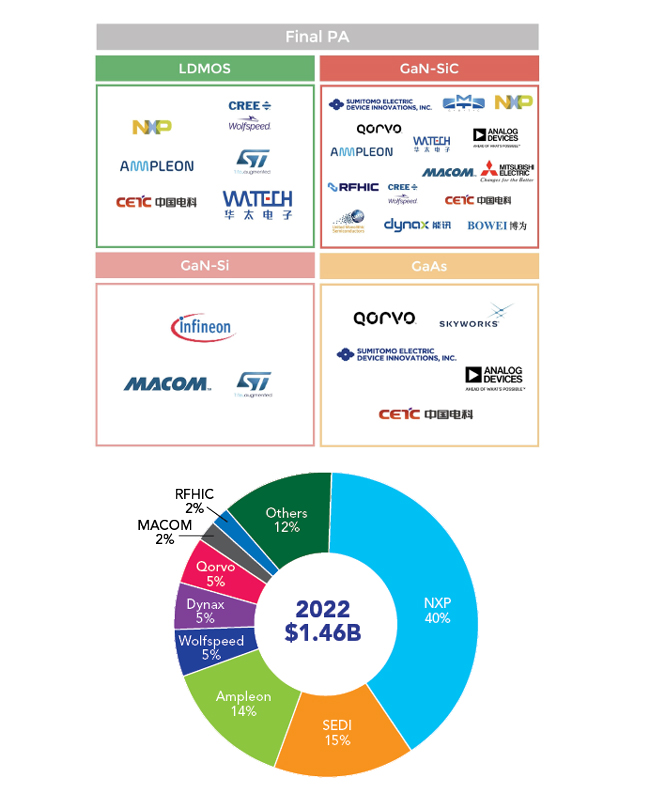

The most significant example of the growing importance of GaN in BTS applications is probably NXP, a key historical LDMOS player. In 2020, they opened a 6-in. GaN fab in the U.S., showing the strategic need to internalize GaN production and to compete with other longtime GaN manufacturers in the BTS market. Sumitomo Electric Device Innovation (SEDI) and NXP, the top two GaN players in this market are seeing increasing competition from Qorvo and Wolfspeed in the U.S. and a few growing players in China, such as Dynax, Bowei and WaTech Electronics.

With the ongoing trade conflict between the U.S. and China, the supply chain tends to be polarized. This is a tough challenge for Chinese players, system and device makers, as well as foundries, because it turns the Chinese ecosystem against the rest of the world. China has been forced to accelerate the development of a local supply chain and with massive support from the government, more companies are emerging in the RFFE field.

The second important lever to improve energy efficiency is artificial intelligence (AI), which is set to play a critical role in dynamic power management. AI is expected to power significant breakthroughs in the telecommunication field as it is now used by many manufacturers to reduce energy consumption. To make the best use of this new feature, PAs will have to support dynamic control of the threshold voltage for low or high traffic modes, optimizing the power consumption as a function of the traffic. To perform smoothly, AI also requires a very low latency network to control traffic and power management in real-time.

With the RAN market expected to peak in 2023, the telecom industry is now looking for new growth drivers. While MNOs are looking toward 5G SA and monetizing their 5G networks, OEMs are getting ready for the second phase of deployment involving sub-6 GHz small cells and mmWave RUs. Thanks to the massive amounts of bandwidth available, potential 5G mmWave use cases are numerous, but as of today, the technology has had difficulty penetrating the market outside the U.S. and Japan. The growth has been slow because the industry is focusing on C-Band mMIMO deployment and the need for mmWave in consumer devices remains to be proven. The mmWave ecosystem is counting on fixed wireless access applications emerging as a killer use case to encourage MNOs to deploy this technology. In the same way, the opportunity for sub-6 GHz small cells remains limited as the cost of installation, which requires fiber at each access point, and the cost of the radios is still too high.

Nevertheless, there is a lot of activity around mmWave and sub-6 GHz small cells from both established RF component makers and emerging companies. For mmWave communication, the industry has chosen to use a hybrid architecture, combining digital and analog beamforming. This architecture requires beamforming integrated circuits (BFICs) integrating four to 32 complete RF chains. These RF chains contain PAs, LNAs, filters, switches and phase shifters and several technology platforms are suitable for these functions. The first BFICs were designed using SiGe or CMOS, but we now see several players turning to RF-SOI for its scalability and good performance. Tier 1 OEMs like Samsung, which has an important mmWave footprint in the U.S., are using in-house designed BFICs.

5G MARKET STATUS

After the RAN market slowed down in 2021 due to COVID restrictions and a tight supply chain, it regained strength in 2022, with more than 2.3 million BTS deployed. In 2023, we expect to see a peak of 2.5 million BTS, with 35 percent of those BTS using mMIMO AAS. The penetration rate of this type of architecture has continuously increased since the beginning of the 5G era. The demand for infrastructure hardware is mainly supported by operators in India deploying 5G networks with lofty ambitions and a sustained rollout in China. India is a new and important market for 5G and the country has chosen to turn toward the Western supply chain, with Nokia and Ericsson as the main suppliers.

The growth in the RAN market is mainly supported by the five big established players: Huawei, Ericsson, Nokia, ZTE and Samsung. These suppliers are trying to consolidate their leading positions by innovating in their RAN portfolio to optimize system size and power efficiency. Huawei and ZTE increased their market share thanks to massive deployments in China and Samsung is capitalizing on its early adoption of virtual RAN (v-RAN) and open RAN (O-RAN) strategies.

Nevertheless, O-RAN and network virtualization represent a major opportunity for other players, such as NEC and Fujitsu, or even smaller players, like Mavenir or Airspan. Companies like Samsung and NEC are showing their ambitions to capture an important part of this market, which is expected to reach up to 25 percent of the annual RAN market by 2025. The small cell and mmWave markets also present an exciting opportunity for small players and newcomers.

The RF component market is directly benefiting from the mMIMO penetration. We estimated the RFFE market at $3.3 billion in 2022 and this opportunity is forecast to exceed $4.2 billion in 2023, including sub-6 GHz small cells and mmWave RUs. In terms of volume, the RFFE market represented almost 1.2 billion RF components in 2022 and it will account for almost 1.5 billion components in 2023. The market is expected to keep growing in volume over the next five years as mMIMO becomes increasingly dominant.

THE BTS PA

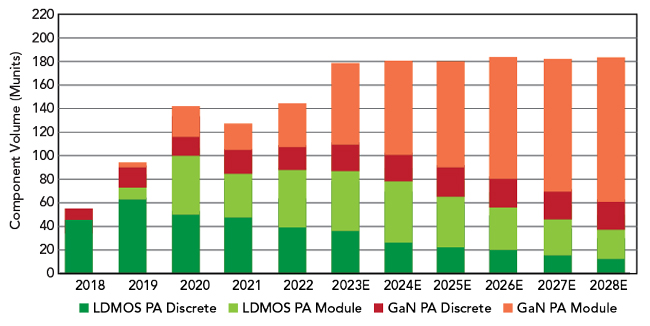

In the RFFE market, the final stage PAs attract most of the attention because these devices account for 45 percent of the overall market, split between LDMOS and GaN-SiC technology platforms. GaN-SiC devices are emerging as winners in this market, but the cost of the technology remains an issue when compared to LDMOS. Under pressure from OEMs and with the GaN-SiC process constantly improving, the technology cost is slowly decreasing. Chip makers are refining their value propositions by proposing multi-chip PA modules, along with integrating more amplification stages and power management features. This offering is well accepted by OEMs as it saves manufacturing and testing time, leading to benefits for manufacturers and system OEMs. From the technology standpoint, PA modules are becoming more complex and diversified; they are monolithic or multi-chip and sometimes combine several technology platforms inside a module. LDMOS is becoming a supporting technology as it provides easy impedance matching when used as a driver, for example. Finally, GaN-on-silicon, expected to bridge the cost/performance gap between LDMOS and GaN-SiC, is likely to enter the market in 2023 for mid-band mMIMO AAS, driven by Infineon. A snapshot of the RF final PA supply chain and market share for all technologies used in RAN applications is shown in Figure 3. Figure 4 shows our estimate for the share of device technology and the evolution toward integrated modules for the final PA stage in RAN applications.

Figure 3 2022 RF final PA supply chain and market share. Source: RF for Radio Access Network (RAN) 2023 report, Yole Intelligence, 2023.

Figure 4 RAN PA technology and integration forecast. Source: RF for Radio Access Network (RAN) 2023 report, Yole Intelligence, 2023.

A wide variety of semiconductor technologies are used in the RAN RFFE, not only for the final PA but also for drivers, switches and filters. The diversity in terms of power levels, frequency and architecture among systems creates a need for complementary solutions to adequately address the demand. This results in a complex technological ecosystem. The industry’s recent technological disruption caused by 5G has created a fragmented market with many players involved. A few players, like NXP, Qorvo, SEDI and Analog Devices, stand out in this market with large market shares. NXP is the uncontested leader with a 35 percent share of the overall RFFE component market. With the expected market growth in the next several years, we will likely see other players generating significant revenue in BTS applications.

CONCLUSION AND PERSPECTIVES

Innovation continues for 5G and the next generation of wireless networks, but price pressure from the MNOs is becoming more challenging for OEMs and chip makers. Fragmented spectrum assets, coupled with an increasing number of available frequency bands are compelling operators to push to combine several bands inside a radio. In response, leading chip makers are designing PAs with very large bandwidths that also support higher transmit powers.

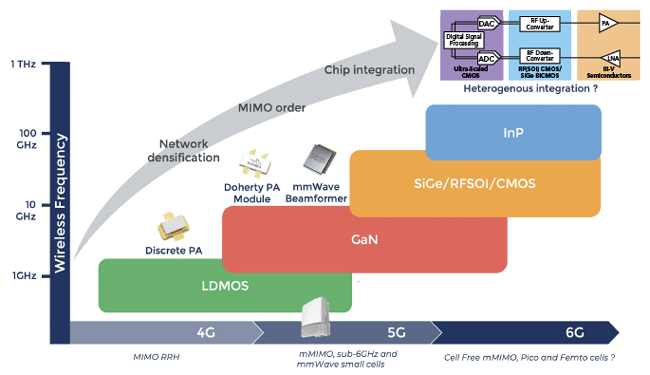

The next step for the 5G standard, 3GPP Release 18, is expected in the second calendar quarter of 2024, and will be considered the first release of 5G Advanced. This new standard will enhance 5G functionalities from the core network to RUs. Beyond 5G Advanced, the industry has begun 6G research, in parallel with many research and development initiatives around the globe. Some of the main challenges for 6G will be how to incorporate sub-THz and THz frequencies. Initial areas of interest are focusing on transmission in 100 to 300 GHz sub-THz bands. Activities in these and higher bands are likely to result in the development of new materials for semiconductors and antennas, novel packaging techniques and advanced semiconductor processes. InP and SiGe are considered potential elements to enable these higher frequency ranges being envisioned for 6G applications. With 5G mmWave applications struggling to find a market, the question of whether 6G will be beneficial if it requires even higher frequencies is legitimate. If 6G does have a path forward, compound semiconductors will play a big role in enabling that future. Our thoughts on a technology roadmap that takes us from 4G to 6G are shown in Figure 5.

Figure 5 A 6G technology roadmap. Source: RF for Radio Access Network (RAN) 2023 report, Yole Intelligence, 2023.