We’re witnessing a transition in the landscape of the RF/microwave industry, arguably a time of unprecedented change as the major players align and consolidate (see Table 1). The currents behind this make for an interesting list: slowing growth in the overall semiconductor market, the ascendency of Apple and Samsung as the two major smartphone manufacturers, the growing complexity of the RF block diagram in the phone, the added performance requirements for the infrastructure to deliver exabytes of data feeding consumer appetites and the stockpiles of cash accumulated as companies recovered from the Great Recession. Responding to these currents, many companies have chosen mergers and acquisitions (M&A), in some cases to diversify, in others to add competencies or gain scale to better compete.

Microwave Journal thought our readers would find it interesting to explore two recent transactions, so we asked Analog Devices (ADI) and Qorvo to respond to a few of our questions about their respective deals. We wanted to get the insider perspective of why these marriages made sense and the work that led up to “the big merge.”

BITS TO ANTENNA

In June 2014, ADI announced an agreement to acquire Hittite Microwave for $2.45 billion, or $78 per share. The price was 29 percent above the closing price of Hittite’s stock on the prior trading day and just under 9× Hittite’s prior four-quarter revenue. The deal closed in just over six weeks, surprisingly fast and a point of pride for ADI.

Hittite’s annual revenue, $277 million, was only a tenth of ADI’s (see Figure 1). So why would ADI acquire Hittite and for such a premium? Both companies were facing the dilemma of slow growth. Hittite’s high margin business model (70 percent gross margin and 40 percent operating margin) had created an expectation among investors that was reflected in the company’s high stock price and market capitalization. While Hittite’s financial performance was the envy of the industry, it restricted the markets they could pursue, and their growth plateaued. ADI was more diversified in products and markets, yet many of their markets (e.g., industrial and automotive) were mature and growing slowly.

Figure 1 Analog Devices, Hittite Microwave, RFMD and TriQuint trailing annual revenue, prior to the close of their respective deals.

From the outside, the combination made sense. ADI’s strength was in data converters and signal processing, and their RF products truncated above a few gigahertz. Hittite’s core was RF, extending into millimeter wave, high power and complex modules for the defense market. The two companies’ product lines had little overlap, perhaps in phase-locked loops and Hittite’s 2011 acquisition of an analog-to-digital converter company that lacked critical mass. With approximately $2.7 billion in annual revenue, $4.8 billion in cash and short-term investments and little debt, ADI could afford to pay a premium. Hittite would enable ADI to address the block diagram from bits to antenna and, a selling point for the investment community, the deal would accelerate ADI’s growth.

Organizationally, ADI clearly endorsed Hittite’s management, appointing Hittite executives to senior roles at ADI. Rick Hess, Hittite’s CEO before the acquisition, now leads ADI’s automotive and communications sector, and Greg Henderson manages ADI’s RF and microwave segment.

ALL AROUND YOU

At Mobile World Congress in February 2014, RFMD and TriQuint announced that the two companies would merge, what they termed a “merger of equals.” Unlike ADI and Hittite, the two were comparable in annual revenue—$1.3 billion for RFMD and $1 billion for TriQuint (see Figure 1). The merger was an all-stock transaction, structured so each company’s shareholders would own approximately half of the new company. RFMD stockholders received 1 share in the yet-to-be-named Qorvo, while TriQuint shareholders received 1.675 shares. The deal represented a 5.4 percent premium over the closing price of TriQuint’s stock on the prior trading day. The merger didn’t close until the beginning of 2015, held up by the review and approval of the Chinese government’s Ministry of Commerce (MOFCOM).

Both RFMD and TriQuint had two business units focused on their key markets: 1) mobile phones and tablets and 2) commercial infrastructure, defense and aerospace. Assessing the two competitors in 2013 showed RFMD stronger in mobile and TriQuint leading in defense, with each strong in separate infrastructure markets. Both companies had gaps in technology and product portfolios: RFMD lacked internal SAW and BAW filter technologies, key to integration in high-end smartphones. TriQuint lagged in Wi-Fi and CATV products for infrastructure.

Although the merger announcement was unexpected, it seemed immediately intuitive. Qorvo would have the full portfolio of technology and products needed to integrate the RF front-end in the mobile phone, better able to compete with Skyworks and Avago (now Broadcom Ltd.). The company would be a strong player in nearly all infrastructure markets, combining RFMD’s position in CATV and Wi-Fi with TriQuint’s in base station and optical. Qorvo would essentially dominate the U.S. defense market for compound semiconductors. Their only threats would be Cree, for GaN opportunities, and MACOM, who had reentered the military market after years of absence.

For the investment community, RFMD and TriQuint committed to $150 million in annual “synergies” — cost reduction — with half realized during the first year of combined operation, the remainder, the following year. The synergies would largely come from eliminating stacked margins: RFMD would no longer buy SAW and BAW filters from an external supplier, and TriQuint’s products would be assembled and tested in RFMD’s internal operations in China.

Reflecting the spirit of RFMD and TriQuint’s “merger of equals,” the executive ranks of Qorvo reflect near-equal apportionment. Bob Bruggeworth, RFMD’s president and CEO, plays the same role at Qorvo, while Ralph Quinsey, TriQuint’s CEO, is chairman of the board. The mobile business is led by Eric Creviston, who led that same business at RFMD; James Klein, from TriQuint, leads the infrastructure and defense segment.

INSIDE VIEW

The outside view is not necessarily the same perception seen by the companies. So Microwave Journal asked ADI and Qorvo a series of questions to get their perspectives.

Q: Microwave Journal. How did you decide that this business combination was a strategic fit, considering technology, products, market share, revenue, profitability and culture?

A: Analog Devices. When we compared our strengths, we saw that Analog Devices and Hittite would support our customers better as one entity, because our solutions had great synergy in end applications. We had highly complementary market and technology leadership: ADI was the leader in high performance signal chains in the analog and mixed-signal space, with solutions up through 6 GHz; and Hittite was the leader in RF and microwave products up through the microwave and millimeter wave range, resulting in virtually no overlap between product portfolios.

The merger has allowed us to develop more highly integrated solutions that combine the best of our respective technologies. This was a perfect fit, because our customers are moving to much higher value products that require more integrated solutions to provide significant advantages and impact in their end applications.

A: Qorvo. Both predecessor companies served many of the same markets and had developed some very complementary technologies. We had core strengths in system design, semiconductor processing, advanced packaging, high volume manufacturing and strategic foundry services. We also recognized that we were capable of serving both high volume commercial and defense customers. For two companies that were more or less in the same line of work, there was almost no overlap.

At the same time, we had different but complementary technologies that were well suited to a combined offering. Our combined strengths and expertise in GaN, GaAs, power amplifiers, switches, filters and tuners are at the core of many new, highly integrated products we are now introducing as Qorvo. We are using this expertise to help solve our customers’ toughest RF challenges, whether in mobile, infrastructure or defense applications. We are well positioned with the core technologies necessary to help our customers accelerate their products to market.

Q: Microwave Journal. Knowing that the investment community expects quickly accretive combinations that will increase the value of the new company, how did you assess the synergies and whether the deal made financial sense?

A: Qorvo. We identified certain cost synergy opportunities before we announced the proposed merger and provided those expectations in the original announcement on February 24, 2014. We expected $150 million in annualized cost synergies — $75 million exiting year one after the merger (completed in January 2015), and an additional $75 million in cost synergies exiting year two. In our first full year as Qorvo, we exceeded our target for achievement of an exit run rate of $75 million in synergies, and we are on track for the previously committed $150 million run rate reduction by the end of calendar year 2016.

A: Analog Devices. A lot of recent M&A activity in the electronics sector has been fueled by the need to reduce costs or rapidly scale business. ADI and Hittite were already running profitable businesses based on a model that our value to our customers is heavily dependent on the strength of our technology. That’s what drove our motivation to merge — with our combined strengths we can help customers break into new frontiers, such as 5G communications and autonomous driving. Our aim is to help them do this faster and more cost effectively by providing access to more highly integrated, power-efficient, high frequency and wideband solutions.

Q: Microwave Journal. Describe the most important steps you took to ensure a smooth combination, both operationally and organizationally. How are you merging overlapping products, organizations, facilities?

A: Analog Devices. Because we had virtually no product overlap, we were able almost immediately to begin combining our technology strengths into something our customers could leverage to improve the performance of their systems. An example of this is our PLL portfolio. ADI had best-in-class phase noise and switching speeds, Hittite had the lowest spurs in the industry. By merging these development teams, we are able to integrate these two technologies into a new generation of products that simultaneously achieve best-in-class performance in all three parameters.

Another area of leverage was in bringing ADI’s advanced packaging technology to the Hittite product line.By leveraging the ADI technology and supply chain we are now bringing to market surface-mount, millimeter wave modules that are 10 to 50 times smaller than previous solutions. These are providing highly integrated functionality—such as a complete E-Band radio—at frequencies up to 100 GHz.

A: Qorvo. Fortunately, both predecessor companies had similar cultures. By benchmarking each other and also looking at best practices outside of the company, we were able to roadmap the best systems, processes, technologies, design and manufacturing resources and products, as well as design our organization that allows Qorvo to achieve our goals of innovation, product leadership, scale and speed. We created two product organizations, Mobile Products and Infrastructure and Defense Products (IDP) and are now moving ahead on a plan that optimizes our manufacturing capabilities across our global footprint.

We have several major ongoing or planned capital projects that will allow us to better serve our customers while maximizing efficiency and cost savings. We’re creating centers of excellence in each of our manufacturing locations that will focus on one or two primary products or technologies (see Table 2). All of these projects will reduce our costs and help our teams to better collaborate. They will also focus our design, manufacturing and technology/product resources where they can be most efficient and effective in achieving our long-term goals and customer commitments.

Q: Microwave Journal. Discuss your philosophy and the process of merging the cultures of two independent and proud companies.

A: Qorvo. Our goal was to create one culture for Qorvo that allows us to achieve our brand promises of innovation, product leadership, scale and speed. We compared best practices of the two predecessor companies and also looked outside of the company to identify best practices in our industry to foster the right culture for Qorvo. We try to reinforce the kind of culture we’re creating through frequent and effective employee communications. We also designed our awards and recognition program around our brand attributes so that we could help nurture the culture we want to create for Qorvo. This allows us to recognize and celebrate success and continuously track our progress. Our new awards and recognition program helps define our culture by recognizing achievement of our strategic objectives, technical achievement including patents and/or invention and brand-building through Qorvo’s author and speaker program.

A: Analog Devices. Our cultures are surprisingly similar, in that they are technology and engineering driven and focused on solving customer design challenges through application-level innovation. The speed at which the companies came together into a highly collaborative team environment was the result of this culture and accelerated our integration to one company.

Editor's Note: See sidebar for another view.

Q: Microwave Journal. How have you improved your value proposition with the combination? What do you offer now that wasn’t possible before the transaction?

A: Analog Devices. Thanks to the merger, ADI is the best positioned company to cover the entire RF signal chain, from antenna to baseband, at frequencies from DC to 100 GHz. With the industry’s largest portfolio and broadest array of technologies, we continue to move deeper into markets as diverse as communications infrastructure, defense electronics, instrumentation and automotive. The acquisition also exposed our collective customer base to a wider range of semiconductor processes, which include CMOS, SiGe, GaAs and GaN, as well as advanced packaging, best-in-class design support tools and a global distribution channel.

From a customer perspective, that means we provide significantly higher value RF and microwave content, both at the component and module level. An example of this value is through the development of highly integrated phased array solutions for markets such as communications, automotive radar and industrial and military sensing. Through development of integrated phased array products, our customers can achieve higher resolution, range and throughput at reduced power consumption and size compared to more traditional architectures. ADI is enabling our customers to achieve all of these requirements, while improving time-to-market and lowering cost, by providing a complete phased array signal chain from the data converter all the way up to the antenna. Also, for customers looking for a module-based solution, we’re developing monolithically integrated phased array chips that can help them reduce complexity and shrink their system footprint in order to improve that needed accuracy.

Phased array and other high frequency applications like E-Band backhaul and emerging 5G technology are also driving customer demand for new classes of instrumentation devices and test and measurement equipment. Test equipment manufacturers turn to ADI, because they know that our technology has to be even better than theirs if we are to help them achieve the right mix of frequency ranges, resolution, speed and performance required to test their customers’ most advanced communication systems.

Global satellite networks represent another rapidly evolving market, as we move closer to the day when every person on Earth is connected by high data rate communications. Customers in the communications and defense electronics markets designing low-earth-orbit satellite networks are especially sensitive to size, weight and power considerations. ADI’s complete antenna-to-bits solutions, with their small form factor and low power, are helping these customers get to market more quickly and at lower cost.

A: Qorvo. We are already starting to see the benefits of our combination in new, highly integrated Qorvo products for Wi-Fi and LTE.

At Mobile World Congress 2016, we announced several mobile Wi-Fi design wins for our new highly integrated front-end modules (iFEMs). We developed a new RF Fusion™ Wi-Fi iFEM, which delivers higher performance than discrete components while saving space and simplifying design for leading smartphone manufacturers. As Qorvo, we are uniquely positioned to design and manufacture all of the high value components in the Wi-Fi iFEM, including high-performance filters, switches and amplifiers.

To help smartphone manufacturers address the technical challenges of carrier aggregation, Qorvo developed the new QM78064 RF FusionTM multimode high band module that offers best-in-class linearity for TD-LTE and full support for TD-LTE intra-band carrier aggregation for enhanced uplink performance. This new module incorporates all major transmit and receive functionality into highly integrated split-band placements. We also ramped to production new highly integrated diversity receive modules supporting 2× and 3× downlink carrier aggregation. These new modules deliver enhanced data rate performance in a highly compact form factor and combine our proprietary LowDriftTM filter technology with high-performance switches and LNAs in a very compact form factor.

Figure 2 Analog Devices closing stock price following the acquisition of Hittite Microwave (from July 22, 2014 through March 11, 2016).

These are just a few examples of many new products we will be introducing that leverage the technology and product expertise we bring to mobile, infrastructure and defense markets as one Qorvo.

Q: Microwave Journal. How do you see this consolidation benefitting the industry and those who work in it?

A: Qorvo. The industry consolidation that started with the merger to form Qorvo is helping accelerate the pace of innovation and industry change that will positively impact RF innovation. In our case, customers benefit from Qorvo’s new scale advantages in manufacturing and R&D and a more aggressive roadmap of new products and technologies. By bringing together all of the critical RF building blocks necessary to simplify design, reduce size, conserve power and improve system performance, we help solve difficult RF challenges facing customers across mobile, infrastructure and defense markets. This helps customers by making mobile handset designs simpler and more tightly integrated, while offering higher performance. It also helps accelerate deployment of next-generation communication infrastructure, from high speed networks to the optical paths that connect them. It benefits defense customers by accelerating development of communications, radar and electronic weapon systems.

A: Analog Devices. Our customers are facing severe time-to-market and cost pressures, especially with the growing demand for increased connectivity in the Internet of Things (IoT) era. By 2020, the market expects to include more than 50 billion IoT devices, many of which will require increased connectivity, higher data rates and the ability to be quickly tested and deployed. IoT networks also support multiple operating modes: from very high data rates, where a device must communicate constantly over short ranges, to very low data rates, where the device may run for months or years without communicating. That level of complexity is overmatching many in-house design teams, who are turning to ADI for wider band, higher frequency solutions and tapping our broad cross section of engineering expertise, which includes sensor, analog, digital, RF and microwave design.

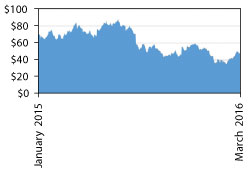

Figure 3 Qorvo closing stock price following the merger of RFMD and TriQuint (from January 2, 2015 through March 11, 2016).

Nearly two years after the acquisition, ADI’s RF and microwave business is stronger than ever. We believe we are a more collaborative, application-focused design partner and our defense, industrial and automotive customers see us as a vital resource as they grow more reliant on millimeter wave technologies for new sense and radar applications. We’re already working with small and large customers to develop advanced technologies for applications up to 100 GHz and we expect to play a vital role in making automobiles safer, industrial equipment more autonomous and our world a more connected place.

OUTLOOK

Anyone who has read the Harvard Business Review or taken a course on M&A has heard that most acquisitions fail. Despite that common view, most of the recent deals in the RF/microwave industry seem to be succeeding, although the final verdict may not be known for some years.

Investor perceptions of the combinations, whatever they may be, don’t jump out from ADI’s and Qorvo’s stock prices. Since the Hittite acquisition closed (see Figure 2), ADI’s stock price has cycled from 28 percent above to 20 percent below the closing share price that first day of trading ($53.75). On March 11, the stock closed 4.1 percent above the first day baseline. Qorvo’s stock has been even more volatile (see Figure 3), appreciating 25 percent before dropping to a trough 51 percent below the closing price on the first day of trading. On March 11, the stock closed 31 percent below the first trading day baseline. With both companies, variations in the stock price generally reflect business conditions rather than a judgment about the deals. During their earnings call last July, Qorvo disclosed a severe downturn in their China base station revenue, which triggered a significant drop in price. Recently, softness in demand from Apple has affected revenue in the mobile segment and the outlook for many of Apple’s suppliers.

Ultimately, the success of ADI and Qorvo will be determined by the markets they serve. Customers in those markets will judge the performance, price, reliability and support of the products offered. ADI/Hittite and RFMD/TriQuint have now been together long enough to see new products emerging from their respective development pipelines. Qorvo made several new product and design win announcements at the recent Mobile World Congress, some reflecting the integration of the two former competitors’ capabilities. This month’s International Microwave Symposium is another opportunity to see what innovations the combination of technologies and manufacturing capabilities will birth