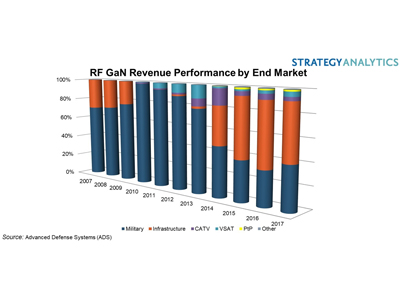

RF GaN market growth continued to accelerate in 2017, with revenue growing at over 38 percent year-on-year. GaN is seeing adoption across a range of RF applications: The rollout of commercial wireless infrastructure coupled with demand from military radar, electronic warfare and communications applications are providing the primary drivers for growth. The Strategy Analytics Strategic Component Applications (SCA) group report, “RF GaN Market Update: 2017-2022,” forecasts that RF GaN revenues will exceed $1 billion by the end of 2022, with defense sector demand slightly greater than commercial revenue.

RF GaN demand from the military sector grew by 72 percent year-on-year in 2017, and this will grow at a compound annual average growth rate (CAAGR) of 22 percent through 2022. The military radar segment will remain the largest user of GaN devices for the defense sector, as substantial production activity in active electronically scanned array (AESA) radars for land-based and naval systems, in particular, driving increasing demand for RF GaN, as many systems previously in development move into production.

Asif Anwar, director of the Advanced Defense Systems (ADS) service, said, “As well as demand from military radar, operational requirements to operate in contested and congested environments, as well as being able to counter modern agile radar and communications, will drive opportunities for RF GaN for the electronic warfare market. Communicating voice, data and video simultaneously and securely over wider and higher bandwidths in an increasingly complex spectrum environment will underpin trends for military communications system design. We expect the associated component demand will also be increasingly underpinned with RF GaN.”

Wireless base stations continue to be the single largest revenue segment for RF GaN, with increasing penetration translating to year-on-year growth of more than 20 percent. While the big lift from Chinese LTE deployments is over, the wireless industry has maintained and, in some cases, compressed the 5G deployment schedule. The resulting 5G base station deployment will become a primary commercial growth driver for RF GaN.

Eric Higham, service director for the Advanced Semiconductor Applications (ASA) service, said, “GaN improves high frequency, instantaneous bandwidth, linearity and environmental performance capabilities, and this allows equipment manufacturers to develop higher capacity, higher power and higher performance radios. 5G deployment will drive opportunities for GaN on multiple fronts, with demand coming from both fixed and mobile applications, operating below 6 GHz, as well as in Ka-Band and higher millimeter wave frequency bands. Opportunities are also growing for RF GaN devices in wireless backhaul and VSAT, and we are seeing traction in the adjacent RF Energy market also.”

Market Leaders

According to Strategy Analytics, Qorvo achieved good growth in their defense-related GaN revenue to maintain market leadership in 2017, widening the gap over rivals competing in the defense sector, including captive suppliers such as Raytheon and Northrop Grumman. Sumitomo Electric Device Innovations (SEDI) continued to be the leading supplier of the overall RF GaN market in 2017, based largely on its dominant position in the base station market, with Wolfspeed, a Cree company, maintaining second position.

The future continues to look promising for RF GaN adoption, even as growth drivers remain in flux.